Why We're Our Own Worst Enemy When Investing

Issue #130: 11 Mental Traps That Cost Us Money. AI-Powered Browser. Random wall-art.

🚀 My Go-To Growth Tools: I put together a list of my favorite tools for writing, productivity, and learning— Check it out here (free).

Welcome to Learn + Grow, where you will learn tips and tools that will help you be 3% more peaceful + productive in just 3 minutes a week.

Key Learnings:

Why emotions often cost us money in investing

11 common mistakes our brain makes

Notes and reflections from my own learning journey

🎓 Learn

Last month, I noticed a book on our coffee table that I hadn't purchased—unusual in our house, where most books are ones I impulsively ordered.

Rethinking Investing: A Very Short Guide to Very Long-Term Investing turned out to be my wife's doing. As a CERTIFIED FINANCIAL PLANNER® professional, she'd ordered it based on a recommendation from my father-in-law (also a CFP® professional).

I tossed it in my bag for a recent trip to Victoria, Canada. What I thought would be light flight reading turned into something much more valuable—a masterclass in why we sabotage our own financial futures.

One chapter hit me like a cold shower: the role of emotions and behavior in investing.

After years of reading books like The Psychology of Money, The Little Book of Investing, and The Snowball, the same truth keeps surfacing:

Unchecked emotions are the biggest reason investors lose money.

Author Charles D. Ellis compiled 11 timeless lessons from Daniel Kahneman's groundbreaking work on behavioral economics. As I read each one, I found myself taking notes—not just about investing, but about the mental traps I recognize in myself every day.

Here are those 11 mental traps, along with my own (sometimes uncomfortable) reflections:

1. Jumping to Conclusions

Acting on partial knowledge is dangerous—particularly in investing. When we buy and sell individual stocks, most of us base most of our investment decisions on remarkably limited information. All too often, we allow first impressions to govern.

My thoughts: I form opinions within seconds. Whether it's a stock, a person, or a restaurant recommendation—my brain wants to "just do it." In investing, that instinct to act fast is expensive. I'm learning to pause and ask: "What don't I know yet?"

2. Getting Distracted by Extraneous Information

A classic example of misjudgment or misunderstanding is the “Linda problem” that was reviewed in Thinking, Fast and Slow. Linda is described as 31, single, and an outspoken philosophy student. She is deeply concerned about discrimination and social justice and participated in anti-nuclear demonstrations. Students were asked to rate the likelihood of several different statements. Two of these were “Linda is a bank teller” and “Linda is a bank teller and active in the feminist movement.” Even though the second description is a much smaller subset of the first, 85% of groups after group believed the second statement was more likely. The Linda issue arises in investing when we get distracted by extraneous information that we wrongly consider particularly relevant.

My thoughts: Stories are seductive. I get pulled into compelling narratives about companies, markets, and trends—even when they distract from basic facts. The more detailed the story, the more convincing it feels, regardless of logic.

3. Preferring Certainty Over Probabilities

For example, if offered a choice of getting a sure $50 over a 50% chance of getting $100, most of us will go for the sure $50—even though the expected values actually are the same.

My thoughts: I definitely prefer the bird in the hand. Safe feels smart, even when calculated risks offer better long-term returns. I'm fighting my instinct to choose comfort over mathematics.

4. Reversion to the Mean is Powerful

Discovered in 1886 by Francis Galton, a polymath of distinction, mean reversion is a particularly important phenomenon for understanding the behavior of market prices. An example is that very tall parents tend to have less tall children and short parents tend to have less short children. Or stocks that just went up in price are less likely to go up immediately thereafter. (There is some evidence of momentum in stock prices in the short term, but that tendency is dominated by other short-term price fluctuations.)

My thoughts: "What goes up must keep going up" feels true in the moment. I have to constantly remind myself that markets—like life—tend to balance out over time.

5. Framing Effects

The way outcomes are described can have a major impact on our views. Consider, for example, the differing impact when something is framed as half-full versus half-empty. Think carefully about how active investment managers describe their recent performance in quarterly newsletters—and focus on the actual results.

My thoughts: Language shapes my emotions more than I'd like to admit. "You lost 5%" hits differently than "you kept 95%"—same reality, completely different emotional reaction.

6. Availability Bias

We are more influenced by easy-to-see evidence, whether it is particularly valuable or not. That is why so many individuals, unfortunately, act on tips from TV commentators about hot stocks.

My thoughts: Whatever's loudest often feels most true. I catch myself paying attention to what's trending on financial media instead of what's actually important for long-term wealth building.

7. Avoiding Faux Intuition

Intuition is divided into two categories. One is the intuition of an experienced expert in his or her field of expertise. The other is the faux intuition—the very prone-to-error judgment of an amateur with little experience. The first is very likely to be right, but the second is likely to be wrong. How often do individual investors accept tips from friends and acquaintances who don’t have any real expertise?

My thoughts: I'm learning to separate true expertise from confident-sounding opinions. In fields like investing, enthusiasm doesn't equal expertise—but it often sounds more convincing.

8. Constructing Flimsy Accounts of the Past

We fool ourselves by creating convenient explanations for what happened—and then believing them far more than we should.

My thoughts: I constantly rewrite history in my head, convincing myself I "saw it coming." It's humbling to admit how easily I trick myself into thinking I "knew it all along."

9. Letting Outcomes Dominate Decision Evaluation

We judge our investment decisions solely by results, even when the outcome involves more luck than skill.

My thoughts: I've celebrated "smart" decisions that were actually lucky, and beaten myself up over sound decisions that didn't work out. Separating process from outcome is harder than it sounds.

10. Anchoring Effects

We anchor to irrelevant numbers, especially in money decisions. That's why investors say, "When the stock gets back to what I paid for it, I'll sell!"—as if the market cares about your purchase price.

My thoughts: I've definitely held investments just because of what I originally paid. "Getting back to even" feels meaningful, even though the market has no memory of my personal breakeven point.

11. Seeing Patterns Where None Exist

A classic example is to ask a group of people to imagine they are repeatedly tossing a coin and record H (head) and T (tail) in a “random” sequence, and also ask one person to toss a real coin and record the Hs and Ts as they occur. The actual coin-tossing record is easily identified because the truly random sequence does not look all that random. It will have longer runs of Hs and of Ts than we think would be random. In brief, we think random should look more “random.” Which sequence is more probable if taken from a long sequence of coin tossing?

H H H H H H H H

H T H T T H T T

Answer: Neither

We fall into the trap of seeing meaning where there is no meaning. So, we think we are good at seeing patterns—even when there is no pattern. Investors do this all the time: “The market was down yesterday, so it will likely be up today,” or “The market was up yesterday, so chances are high that it will be up again today.” No wonder we have a difficult time appreciating random walks and random numbers. We seek to find patterns, and we do “find” them, even when the data are just random.

My thoughts: This one stung. I'm always looking for patterns—"The market was down three days in a row, so tomorrow it has to bounce back." I've made trades based on these imaginary patterns, like thinking Friday selloffs mean Monday rallies. But when I actually tracked it, there was no correlation. Now, when I catch myself thinking "this always happens," I remind myself that markets are largely random in the short term.

The Simple Truth

Kahneman's research proves what every experienced investor knows:

We are often our own worst enemy.

The good news? I don't need to win against these emotions every single day.

My reminder to myself is simple:

Stick with low-cost index funds

Hold them for the long term

Don't let short-term noise push me around

Work with fiduciary financial advisors

It sounds boring. But boring works.

Because when it comes to investing, the biggest danger isn't market volatility.

It's the person staring back at me in the mirror.

Here are a few more readings on “money and investing”

Understanding Money and Wealth Through Naval Ravikant's Wisdom

From Poverty to Prosperity: Money Lessons I Learned From My Millionaire Journey

🚀 Growth Tip

If you haven’t already, I encourage you to try an AI-powered browser. I’ve been using Dia (it’s invite-only, so sharing my link), and there’s also Comet by Perplexity. Both are worth exploring — they can unlock more productive and creative ways to browse the web.

🤩 Inspiration

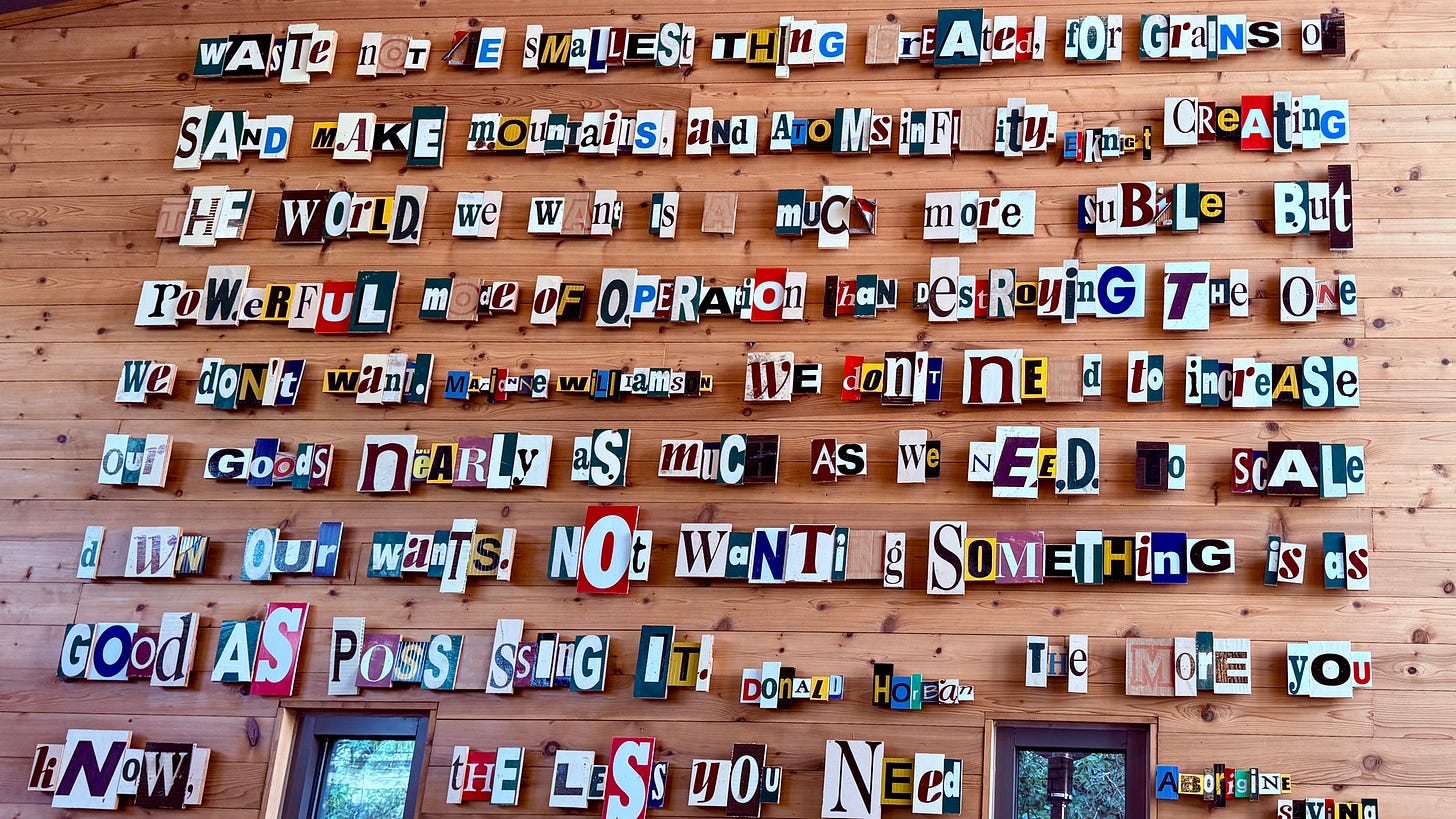

For the next few days, I’m staying in a little cabin in the woods, about an hour south of Austin. I’m calling this one of my “Growth Trips” — time set aside to read, reflect, and reconnect with nature.

Yesterday, I went out for dinner nearby and came across a piece of art on the wall. It carried a few inspiring thoughts that really struck me, and I thought you might enjoy them too.

👋 Until next time, Anil / CEO and Co-Founder of Multidots, Multicollab, and Dotstore.

May the Peaceful Growth be with you! 🪴

More Ways to Learn + Grow

#1: Are you a founder (or dreaming of becoming one)? If you want actionable strategies to scale your agency to $10M, give Peaceful Growth a read.

#2: Work with WordPress or build on it? Check out WP for Enterprises —your backstage pass to how BILLION-DOLLAR websites run.

#3: My Go-to Tools for Productivity & Growth 👇🏾